Stable Cryptocurrency

100% Backed by Assets

Fully Transparent

Peg your Assets and Stabilize the Crypto-World

Stablecoin will transform the financial industry with a currency that is stable and secure for businesses to sustain in the ever-changing monetary values.

Financial services are no longer an elitist. Blockchain Technology ensures that everyone has equal access to financial institutions.

The asset-backed cryptocurrency for the 21st century which is designed to maintain a stable value across jurisdictions without a change in value.

The trading happens on margins due to the opening of collateralized debt obligation(CDO) thereby increasing the exposure to the underlying asset.

The responsibility lies with the token holder to make risk-based decisions influencing the health of the ecosystem of the stablecoin.

Cloud-based mining ensures that miners do not require sophisticated equipment to mine the gold backed or currency backed cryptos.

Assets with liquidity will help you to raise funds for your project in a secure and stable form of money. When the price increases additional tokens are minted to maintain the stability.

Building an ecosystem to orchestrate consensus at a faster speed, with reduced energy usage while having higher transaction throughput.

Stablecoins are crypto-to-fiat currency which enjoys widespread acceptance in the exchanges. These can be easily traded at several exchanges such as Bitfinex.

Cryptocurrency issued represents the value of gold i.e. 1 gram of gold equals 1 crypto. This gram of gold is secure with a custodian, preferably a third-party and can be traded.

Peg your cash-reserves such as USD, Euro or Japanese Yen and create a stable currency backed with assets. Each coin or token issue represent 1 USD or 1 Euro or 1 Yen.

Create a diamond-backed or ruby-backed or any other precious stones for a stable precious stone market. Each cryptocurrency issued represents 1 carat of diamond.

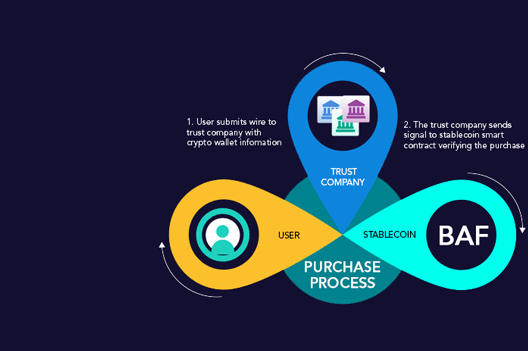

The assets such as cash, precious stones, gold bars are entrusted to a third party trust. We will conduct KYC/AML checks about the assets, after sending to the trusted third party through an escrow agreement. Once these are verified, the API will instruct the smart contracts to issue equivalent amount to tokens will be sent to the public address of the token holder.

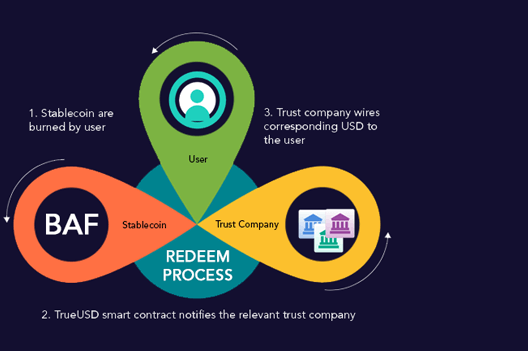

For redeeming the asset, a KYC/AML check will again be carried out. needs to be conducted. The users need to send asset tokens to the smart contract from a registered wallet address, prompting the escrow bank to distribute the funds. This ensures that the asset is not touched by the system. All receipts are carried out by the trust companies through Escrow accounts.

The volatility of the cryptocurrency created an opening for a source backed by real-time assets with low volatility. That is the stablecoin and it is used for maintaining transactions.

Stablecoin development companies know the process and they do possess the experience to build a stablecoin. Unlike cryptocurrencies, they have a lot of formalities to be taken care of.

They are backed up by real assets which can be fiat or gold or any other real estate assets. With these assets backed up, they can show less volatility.

There are different types of stablecoins, and they include asset-backed stablecoins, Crypto-backed stablecoins,commodity-backed stablecoins.

To develop the stablecoin the need for technical attributes like blockchain & a professional development team is mandatory. More importantly, the asset that's gonna back the coin will be decided and procedures are carried out.

The cost of the stablecoin development is based on the requirements the user needs, the price range will scale up by adding the features or new technologies in the development.